The Gamma Scalper's Solo: Trading, Jazz, and the Art of Improvisation

Is true freedom found in the absence of rules, or in mastering them so completely that you can move effortlessly within them? A child with a piano has no rules and creates only noise. A master pianist has internalized every rule of harmony and theory, and from that deep structure, creates magic.

This paradox sits at the heart of all great human endeavors, from art to life to the financial markets. We search for a rigid playbook, a guaranteed script for success, only to find that the real masters are not the ones who follow the script best, but the ones who know how and when to improvise.

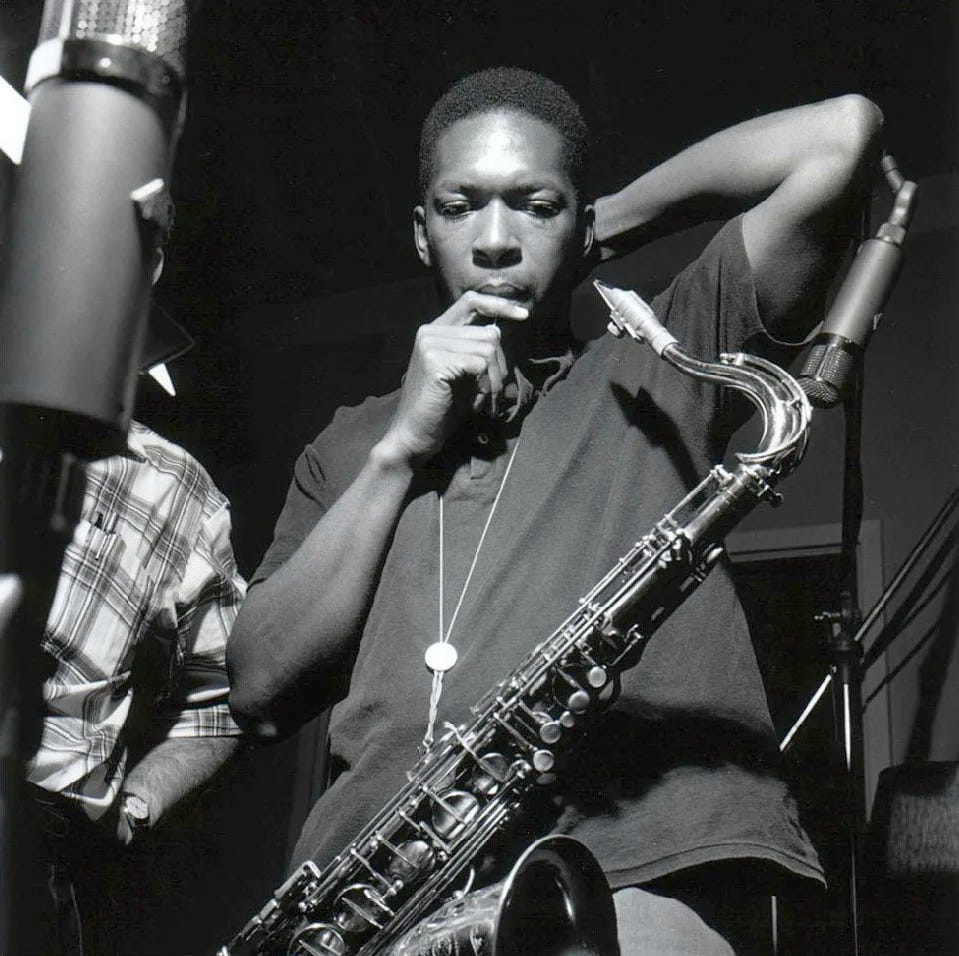

If you’ve ever listened to John Coltrane’s modal jazz, you’ve heard this freedom in action. It’s music built around a harmonic framework that, instead of confining the artist, liberates them. And in the complex world of options trading, there is a force that does exactly the same. It is, perhaps, the very soul of the option. It’s called Gamma.

The Soul of the Option, Gamma (Γ)

For our curious minds still getting acquainted with "the Greeks," most beginners first learn about Delta (Δ). Delta is an option's exposure to direction. It tells you how much the option's price will move if the underlying stock moves by $1. It's simple, linear, and easy to grasp.

But the real magic lies one level deeper. The master of puppets is Gamma (Γ).

Gamma is the rate of change of Delta. It measures acceleration. If Delta is the speed of your car, Gamma is how hard you’re pressing the gas pedal. A position with high positive Gamma is a thing of beauty:

When the market moves up, your Delta increases, making your position automatically "longer" and more bullish.

When the market moves down, your Delta decreases, making your position automatically "shorter" and less bullish (or even bearish).

In other words, a long Gamma position is a position that adapts. It is a structural advantage that bends and contorts in your favor. It’s a framework that, like the scales in modal jazz, gives you the freedom to play.

The Jazz of Improvisation

A rigid, classical piece of music has a flawless map, a guaranteed script. The goal is perfect execution. Modal jazz is different. It provides a structure—a set of scales, a harmonic mood—and then invites the musician to explore. To adapt. To improvise.

The best traders, like the best jazz musicians, never follow a rigid playbook. They understand a strategy that worked yesterday may collapse tomorrow. Survival demands improvisation, not blind adherence. In both disciplines, you must first know the scales. You must master the chords. But your true edge emerges when you know precisely when to break from the written music and react to the feeling in the room. In jazz, forcing a melody shatters the music. In trading, forcing a setup shatters your account.

Playing the Market's Melody

Here is the beautiful, fractal connection: Actively managing a long Gamma position is the financial equivalent of playing a jazz solo.

A trader who is long Gamma and wants to profit from it doesn't engages in something called "Gamma scalping." As the market moves up and their Delta increases, they sell a little of the underlying asset to bring it back to neutral. As the market falls and their Delta decreases, they buy a little back.

It is a conversation with the market's rhythm.

The trader's profit doesn't come from one big, heroic bet on direction. It comes from the sum of these tiny, improvisational adjustments. They are harvesting the market's volatility, turning its chaotic noise into a steady stream of income. They are playing their solo. Their long Gamma position is the harmonic structure, the scale that gives them the freedom to play. The constant buying and selling, the scalping, is the solo itself.

Force equals failure. Improvisation equals survival.

Me encanta tu manera de hilar tan fino, Juan. Maravilloso artículo!!!

This article is a masterful blend of finance, art, and philosophy, and I genuinely enjoyed reading it. What makes it stand out is the way it takes a highly technical subject—Gamma in options trading—and brings it to life through the metaphor of jazz improvisation. It doesn’t just explain a financial concept; it makes you feel it.